federal tax abatement meaning

Tax abatement requirements can be changed or can be modified. The federal tax abatement is equal to 10 of taxable income earned in the year in a Canadian province or territory.

This can help site.

. Tax Abatement Meaning. The federal tax abatement reduces Part I tax payable. Income earned outside Canada is not eligible for the federal tax abatement.

Money saved by reduced business taxes can be invested in other parts of the community. Reasons that qualify for relief due to reasonable cause depend on the type of penalty you owe and the laws in the Internal Revenue Code IRC for each penalty. Income earned outside Canada is not eligible for the federal tax abatement.

Provincial Abatement 10 Taxable Income earned in a Canadian ProvinceTerritory. What is a tax abatement in Texas. This recurring expense doesnt go away.

Information about Form 843 Claim for Refund and Request for Abatement including recent updates related forms and instructions on how to file. The federal tax abatement reduces Part I tax payable. You may qualify for relief from penalties if you made an effort to comply with the requirements of the law but were unable to meet your tax obligations.

Property taxes represent a major expense for most homeowners typically amounting to 1 to 3 of the homes value each year. Taking advantage of federal state and local tax incentives and credits allows a brownfield developer to use resources normally spent to pay taxes for other purposes. A corporation earns income from.

As of 2017 that provides a flat 10. On line 608 enter the amount of federal tax abatement. IRS Definition of IRS Penalty Abatement.

The Quebec Abatement consists of a reduction of 165. The federal tax abatement reduces Part I tax payable. Community may deteriorate and ultimately hurt property owners.

Tax abatement defined as the decreasing of the tax responsibility of a firm by government is one of the tools which government uses to motivate. Tax abatement or a tax holiday means that a persons tax obligations are reduced by a certain amount. This 10 deduction is meant to leave room for the provincial tax rates.

The Quebec Abatement is the sum of the Alternative Payments for Standing Programs and the Youth Allowances Recovery. Most states or jurisdiction have their own rules and regulations. In other words when your taxes are abated it.

On the federal level the critical abatement any accountant or bookkeeper should know is the federal tax abatement for corporations. Tax Abatement Definition. Tax abatement requirements can be modified.

It S Crunch Time For Tax Abatement When Must Co Ops And Condos Pay Their Employees Prevailing Wages Cooperatornews New York The Co Op Condo Monthly

Dividend Gross Up And A Dividend Tax Credit Mechanism

What Is A Tax Abatement Quickbooks Canada

How Much Is The Coop Condo Tax Abatement In Nyc

What Is Tax Abatement A Guide For Business Operators

What Is A Tax Abatement Quickbooks Canada

Module 8 Taxable Income And Tax Payable Pd Net

Chapter 15 Taxable Income And Tax Payable For Corporations Ppt Download

Kalfa Law Business Tax Rates In Canada Explained 2020

50 Irs Penalty Abatement Reasonable Cause Letter Ls3p Lettering Word Doc Words

Tax Abatements The Basics National Housing Conference

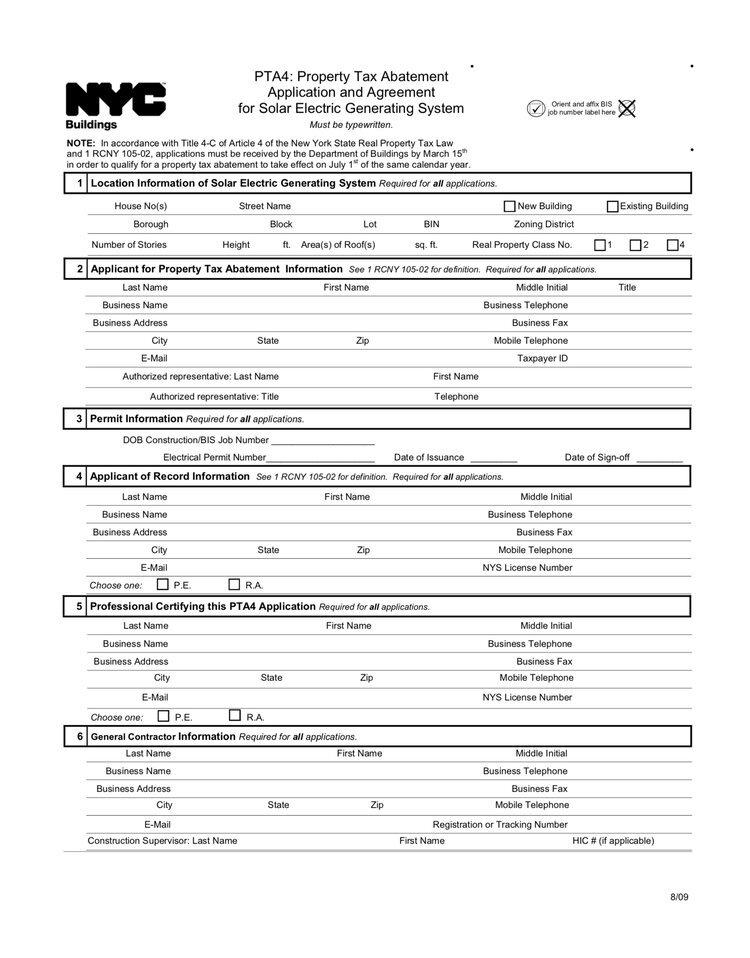

Nyc Solar Property Tax Abatement Pta4 Explained 2022

Chapter 15 Taxable Income And Tax Payable For Corporations Ppt Download